Digital Transformation

Clients & Services

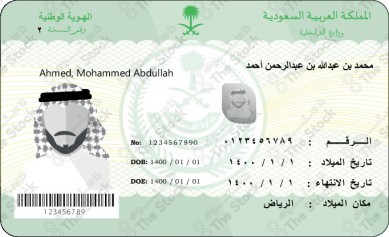

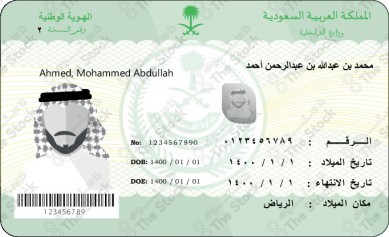

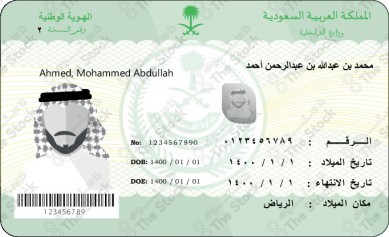

E-KYC and E-KYB verification and on-boarding

Our identity verification services are designed to simplify the onboarding process for new users. By utilizing our solution, you can enhance the accuracy of your identity verification while significantly increasing your pass rate. We focus on reducing false positives and improving overall efficiency, allowing you to verify international users in seconds. With a strong commitment to ensuring compliance with industry standards and regulations, we help you streamline your identity verification processes while maintaining the highest levels of regulatory adherence. Partner with us to elevate your identity verification experience.

Digitization of Governance, Risk, Compliance, AML

The COVID-19 pandemic accelerated the digitalization of various sectors, including corporate governance, as organisations rapidly adopted digital measures out of necessity rather than strategic planning. This abrupt shift led to increased digital security risks, exacerbated by the lack of rigorous regulatory evaluation typically conducted under normal circumstances. This is where our Corporate Governance solution comes in. Our CG solution provides you with a flexible framework to streamline the management of your organisation’s policies and procedures. The solution allows you to automate the process of development, maintenance and communication of policies and procedures across the organisation. It acts as a central repository to store, organise and manage regulatory policies and procedures.

In today's rapidly evolving business landscape, organizations face increasing operational risks due to expansion and heightened customer demands. To ensure seamless processes and maintain operational integrity, it is crucial to identify, assess, and mitigate these risks effectively. Our Operational Risk Management (ORM) solutions are designed to address the inherent challenges of internal processes, systems, and human factors, enabling businesses to proactively manage their operational risks. By implementing robust risk management frameworks and control measures, we help you safeguard against financial losses and reputational damage while ensuring business continuity and regulatory compliance.

Our Regulatory Compliance Management solution helps banks stay abreast of evolving regulatory requirements, ensure adherence to laws and regulations, and mitigate compliance risks effectively. By centralising compliance efforts and providing real-time alerts of compliance status, our technology enables banks to enhance efficiency, reduce manual efforts, and minimise the risk of non-compliance including AML/CFT.

Loan Origination

To satisfy the increasing need for convenience, simplicity and customised service, modern lenders need to transition from a transaction-focused approach to one centred around the customer. At the same time, they must pursue strategic growth objectives to maintain a competitive edge. Meeting these challenges necessitates an intelligent loan origination platform that can streamline operations while fostering engagement and innovation. Developed by lending and technology experts with over 30 years of experience, Our Corporate Loan Origination System (LOS) goes beyond being merely a system of record; it serves as a catalyst for engagement and expansion. With our Corporate LOS, navigating the complexities of the traditional lending model becomes achievable with a few clicks. While providing comprehensive core lending functionality, Our Corporate LOS’s adaptable architecture enables you to stay ahead of emerging trends, expand into new markets, and power your future endeavours.

Branch Automation

From fund transfers to account openings, our system empowers your team to deliver exceptional service with ease. Our platform streamlines client interactions, efficiently manages fund transfers, and simplifies account opening procedures. Automated request processing ensures that your operations run smoothly.

Kiosk self-service machines

At Equity Corp, we provide advanced kiosk solutions tailored to various industries, including banking, retail, and government services. Our kiosks empower users to perform transactions such as account management, payments, document submission, and identity verification—all without the need for human assistance.

Documents reading

Intelligent Document Processing is an AI-driven document extraction platform that helps to extract semi or unstructured data and information from complex documents. IDP makes cognitive and repetitive document processing simple. It automatically identifies, extracts, validates, and stores complex pieces of information from any kind of document with a record >85% accuracy and a proven >90% reduction in processing time. This saves cost and improves the overall performance. The accuracy of IDP offers a competitive advantage by providing a deeper level of semantic understanding of documents through linking contextual elements. It offers access to data lakes and provides opportunities for highly specialized workflows within an organization.

Remittance

End-to-end cross-border payment solutions for financial institutions and businesses to make cross-border payments faster, cheaper, interoperable & more transparent

Interactive personalized communication

Customer Experience Management (CEM) is the set of processes that a business uses during the customer lifecycle to track, supervise and coordinate any interaction between a customer and the organization. CEM is a holistic perception of a customer experience with a business or a brand.

Conversational AI (Chatbot)

Conversational AI is evolving the way people interact with technology. From speech-enabled interfaces to intelligent virtual assistants and chatbots, it is becoming increasingly apparent that customers are looking for a more human-like experience.

Data cleansing and migration

Data Clear is a fully integrated solution that enables businesses to leverage the potential of near-real-time data analytics and reporting. Our end-to-end solution allows organizations to effortlessly collect data from various sources and systems, ensuring its accuracy and consistency during the process before transferring it to multiple data repositories for analysis and valuable insights. With Datability Clear, generating operational reports and dynamic visual representations of business performance can be done within a few clicks, all guided by essential key performance indicators. With the help of our comprehensive solution, it is easy to make informed decisions and gain valuable insights. Datability Clear ensures your organization has a single source of truth (SSOT) for your data, and your data is on-time, complete, accurate, and reliable to empower every decision in your organization. The data migration process can be challenging during a systems integration project for anyone when moving data from one extensive system to another. But with our product's track records in hundreds of massive data migration projects, with an end-to-end advanced data migration process, your team will succeed in the most challenging data migration operations with ease, confidence, maximum security, and efficiency. Our subject matter experts apply industry best practices and follow appropriate guidelines that help clients analyze the challenges, prioritize project expectations, and identify and mitigate risks.

Brokerage solution

The solution is a family of products that empowers various investment businesses with every necessary tool for a more efficient and competitive trading and investment business experience. The products included can help investment businesses automate with ultra-high volumes, directly connect to market and data streams, and manage and execute orders in a seamless performance. The product is designed to deliver all the needs of investment businesses with fully-featured integrated dashboards for a remarkable experience to every customer and business user. Every product is developed with an architecture that guarantees blazing-fast speed and best-in-class security that ensures business growth and high competency.